virginia military retirement taxes

Lawmakers can help achieve something thats long overdue. It also provides seniors with a.

Nebraska Taxation Of Military Retirement Pay Lutz Accounting Blog

To help make that possible we are working diligently to eliminate taxes on the first 40000 in military retirement pay.

. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year provided they are on extended active duty. That amount increases by 10000 each year until 2025 when up to 40000 is deductible. Out of the 50 states in this great union 9 states do not have a personal income tax 22 states do not tax military retirement pay 16 only tax a portion of it only leaving 3 states that fully tax.

Eliminating the tax on the first 40000 military retirement. An additional exemption of up to 17500 is available for veterans under 62 who have at least 17500 of earned income. For the 2022 tax year Veterans age 55 and over who are receiving military retired pay can deduct 10000 from their Virginia taxable income.

This subtraction will increase each year by 10000. Members of the Virginia General Assembly are already hard at work balancing the books for the budget this year. For taxable years beginning on and after January 1 2 023 but.

In 2022 up to 10000 in retirement pay is tax free for retirees 55 and older. Virginia has a number of exemptions and deductions that make the state tax-friendly for retirees. Balancing withdrawals from tax-deferred accounts and the tax-free Roth may keep you in a lower income tax bracket and could reduce your Medicare premiums.

For taxable years beginning on and after January 1 2022 but before January 1 2023 up to 20000 of military benefits. Many states also exempt active. This means our Armed Forces retirees will see a larger.

Veterans ages 62 to 64 are eligible for Georgias existing. Lets eliminate the tax on the first 40000 in military. Glenn Youngkin signed two bills Friday to reduce state income taxes on military retirement income for veterans ages 55 and older.

Military Retirement and State Income Tax. According to a press. Our message is simple.

As you enter retirement dont let confusion about your taxes keep you from enjoying everything Virginia has to offer. Virginia - In 2022 up to 10000 in retirement pay is tax-free for retirees 55 and older. When you come back to the.

It exempts all Social Security income from the state income tax. With a few exceptions if a source of income is taxable at the federal. A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states.

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com

The Best States For Military Pay Taxes

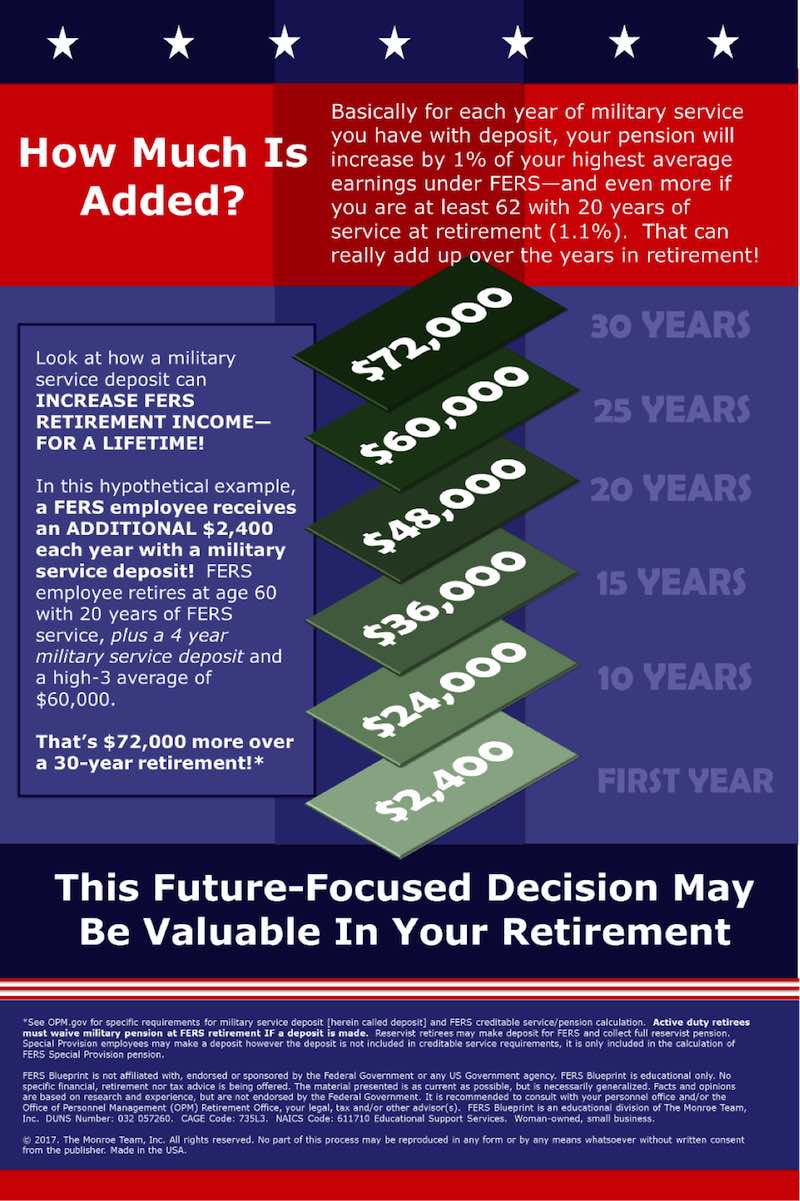

How To Use Military Service To Increase Your Fers Pension Fedsmith Com

Maj Gen Crenshaw Keep Veterans In Virginia By Reducing Retirement Taxes The Roanoke Star News

Moaa State Tax Update Details On New Virginia Retiree Exemptions And Much More

These States Don T Tax Military Retirement Pay

Retired Military Finances 101 Taxes C L Sheldon Company

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com

Tax Free Military Retirement Pay In These States

State Tax Information For Military Members And Retirees Military Com

13 States That Tax Social Security Benefits Tax Foundation

49 Things You Need To Know Before Military Retirement Katehorrell

Is Military Retirement Income Taxable In North Carolina

Military Retirement Pay Will Now Be Totally Exempt From State Income Tax In These Two States Military Net

Can You Receive Va Disability And Military Retirement Pay Disabledvets Com

State Tax Roundup New Year Will Mean Big Tax Breaks For Thousands Of Retirees Moaa

States That Don T Tax Military Retirement Turbotax Tax Tips Videos